Car mileage depreciation calculator

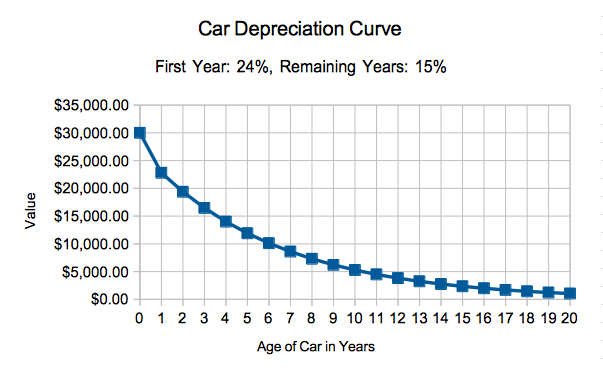

Since you dont spend money on gas with an electric car its likely that the mileage deduction will get you a bigger tax break. The Car Depreciation Calculator uses the following formulae.

Car Depreciation Calculator Best Sale 59 Off Www Wtashows Com

The calculation is easy enough.

. Assuming accumulated mileage of 15000 miles per year. If you frequently drive your car for work you can deduct vehicle expenses on your tax return in one of two ways. The deduction for the 2022 tax year is.

For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. Rigidity in tires allows for greater frictional interaction. To use the calculators depreciation formula on line 10 enter the total price you paid for your new or used vehicle including sales tax.

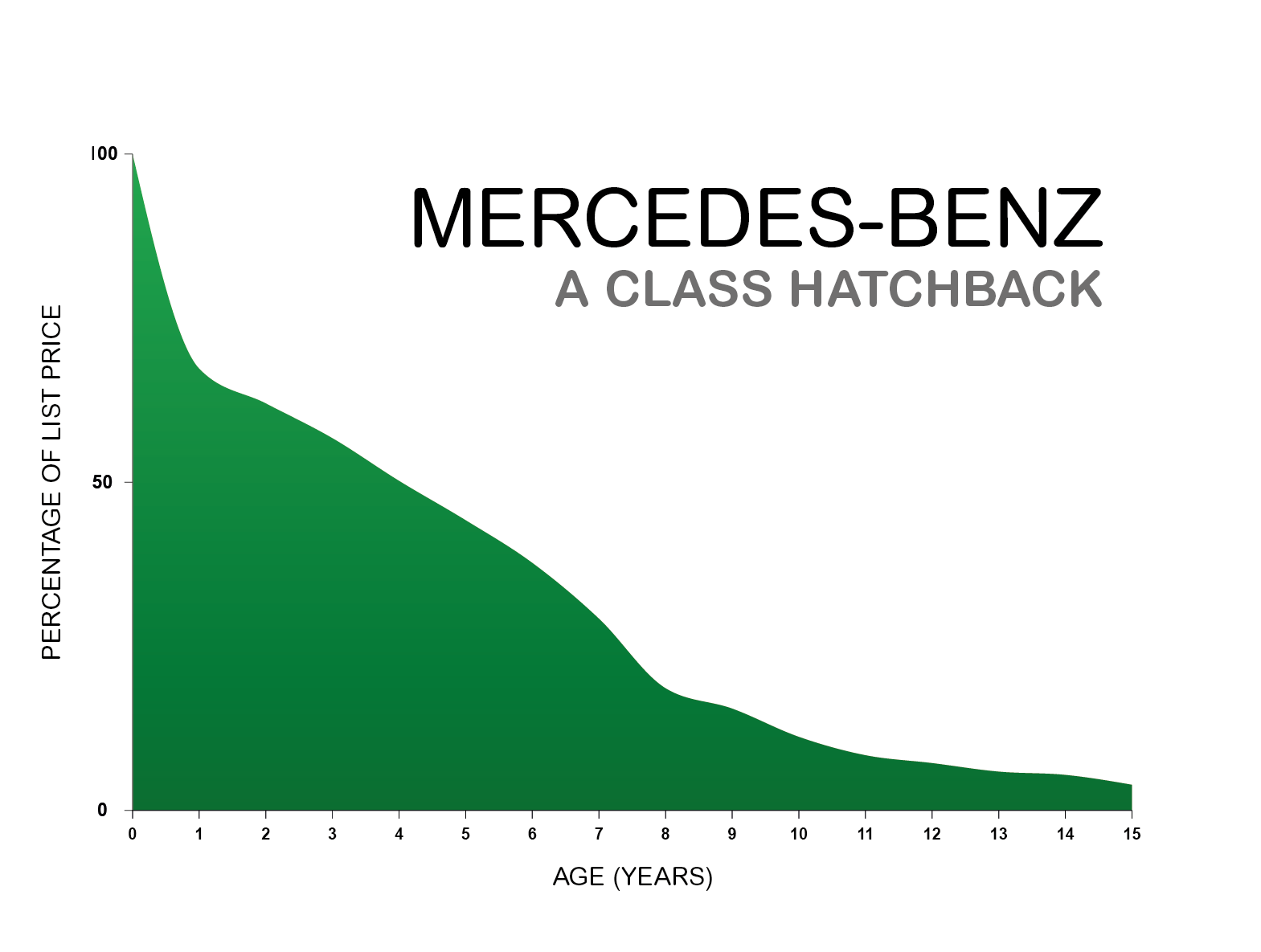

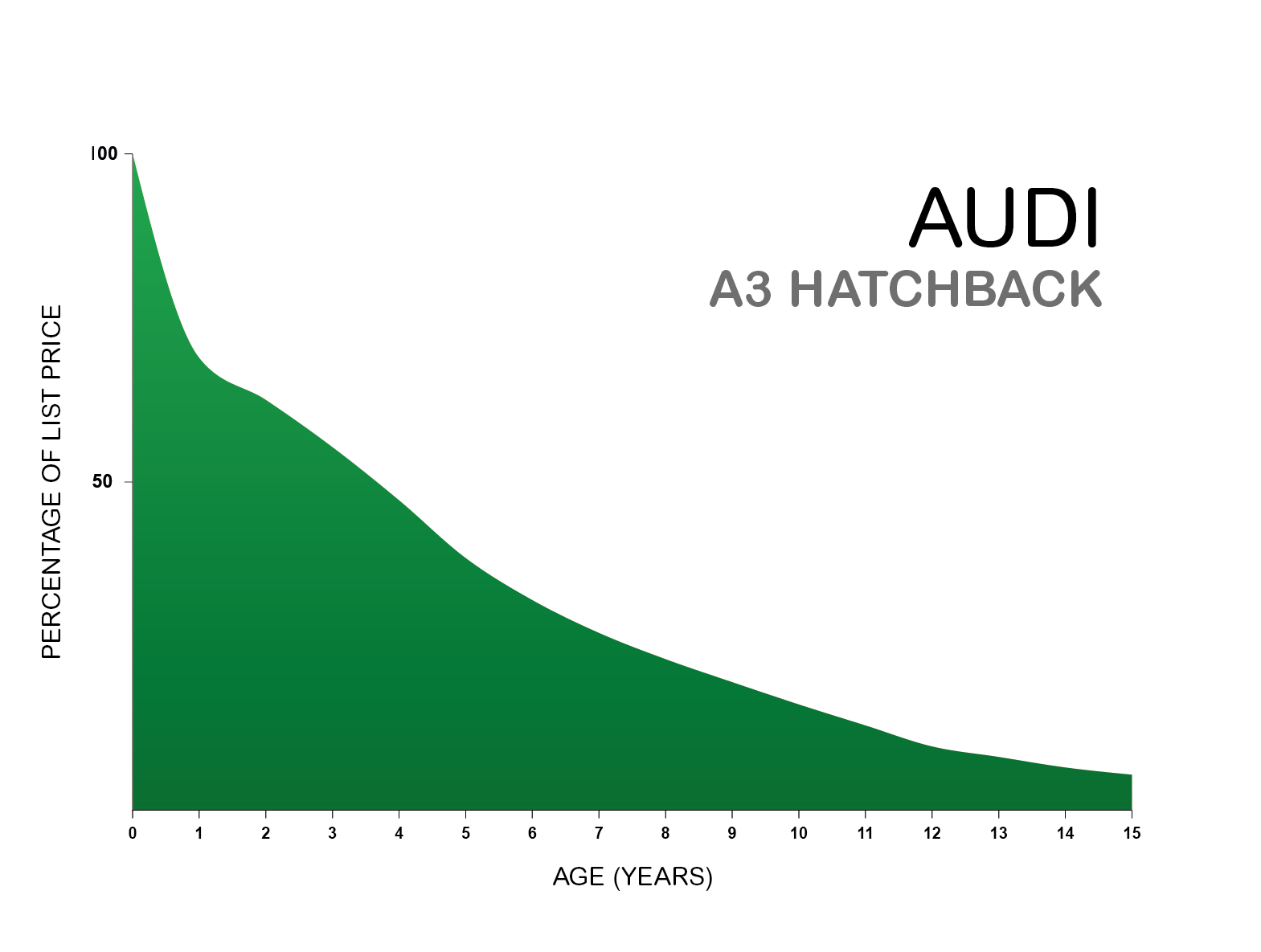

Times that by 100 which will then equal the cost per mile. A P 1 - R100 n. A cars residual value is largely determined by its age and mileage.

The standard mileage deduction requires only that you maintain a log of qualifying mileage driven. Calculate your cars value for free test your knowledge with our quiz or learn more with our user guide. The second method is estimating the initial value of the car.

Here are some of the biggest factors that lead to car depreciation. We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time. How to calculate mileage-based depreciation on a used car is equally simple if you take the formula at face value.

The more miles you drive the less your car will be worth. -Year of manufacture and Mileage. By powering all four wheels the engine works harder to move a car the same speed at higher speeds.

585 cents per mile up 25 cents from 2021. It will also allow you to look at how a vehicle will depreciate in a certain number of. Where A is the value of the car after n years D is the depreciation amount P is the.

If you bought used input the difference between the cars expected longevity and its mileage when purchased eg 200000 65800 134200. If it doesnt look good try plugging in lower car payments and less depreciation which you can achieve by getting a used car. You can now compare it to the price of a brand new car.

Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Keep Mileage Low. We cover how valuation works depreciation and how to get the most value out of your car.

Get accurate auto lease payment pricing on any car at Edmunds. Lets assume you were looking to buy a three-year-old car for 12000. How much can you write off for car depreciation.

Own years 2. Fill out the details about a car eg. A car value in the UAE depreciates quite significantly in the first few years especially when the shape changes but this rate of depreciation slows down as the car gets older.

Some you can sort of control and others you cant. Get accurate auto lease payment pricing on any car at Autotrader. How to calculate mileage-based depreciation on a used car.

The best way to minimize depreciation in a car is to keep the mileage low. Depreciation and market value for Australian vehicles is influenced by several factors including the cars age condition fuel efficiency maintenance quality mileage whether its auto or manual and the manufacturersmodels reputation. How Much Should I Set Aside for 1099 Taxes.

If you input the value into the 3 years box the car depreciation calculator will display the cars initial value in this case over 20500. You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 16 cents per mile for 2021 or you can deduct your actual costs of gas and oil. Knowledge is power Share this resource with.

You can use low medium or high depreciation. That 30000 is its residual value the leftover worth of the car after a certain amount of use. Monthly Rent Charge Money Factor 0020833 123.

Take the depreciation rate per year and divide that by the cars annual mileage. Who Can Deduct Mileage for Medical Reasons. No text Own years 1.

The lower will be the average annual cost of depreciation. Free car lease payment calculator - calculate your monthly lease payment. Edmunds True Cost to Own TCO takes depreciation.

Since there arent really much cheaper new cars than 2000025000 it tells me Im going to have to get a used car. Road Trip Calculator. In most cases 200000 miles.

Additionally the more a car is driven each year the further it is going to depreciate-Car Condition. Plug in a scenario and see how it looks. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

Let Kelley Blue Book help you understand a cars 5-year cost to own beyond its purchase price when you consider out-of-pocket expenses like fuel and insurance plus the cars loss in value over. This total car cost calculator will not only calculate the annual monthly and per mile cost of buying owning and operating an automobile but it will also allow you to calculate those costs side-by-side with a second car buying scenario. The number of miles on a vehicle is one of the first things people look at when deciding whether to buy or not.

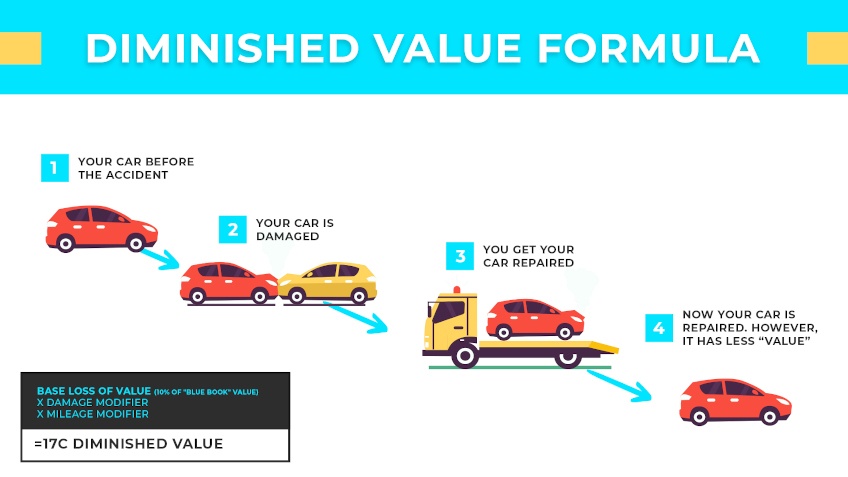

D P - A. Loan interest taxes fees fuel maintenance and repairs into. The difference between a cars price and its residual value is the cars depreciation.

You drive an electric vehicle. TiresUnder-inflated tires can lower gas mileage by 03 per PSI drop due to wasteful transfer of energy dissipating into the mushiness of the tires when they are underinflated. If neither is relevant to you consider the standard mileage method.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. Car Price Negotiation Guide. Thats how the calculator can really help you.

Mileage gearbox and options. Car lease terms usually. The first and most comprehensive method is to document all of your car expenses including gas maintenance insurance and depreciation.

The actual expenses method lets you deduct depreciation on newer vehicles and the cost of gas. Free car lease calculator - find your monthly lease payment. But if you can keep your cars mileage down your car will hold more of its value.

If you choose the mileage you wont be able to claim depreciation as a standalone deduction -- its already included in the standard mileage rate. Now several factors can put a dent in your cars value. Calculate the cost of owning a car new or used vehicle over the next 5 years.

In our example the 50000 car that you negotiated down to 45000 because youre such a good dealmaker is worth 30000 at the end of the lease. Car Depreciation Calculator. You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 75 of your adjusted gross income AGI.

How Car Buy Rater Works The Methods It Uses To Evaluate Cars

Car Depreciation Rate And Idv Calculator Mintwise

Car Depreciation Explained With Charts Webuyanycar

Car Depreciation Calculator On Sale 51 Off Www Wtashows Com

Research Which Cars Suffer From Depreciation The Most

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Car Depreciation How Much It Costs You Carfax

Car Value After Accident How Much Value Does A Car Lose

What Is Car Depreciation

Annual Depreciation Of A New Car Find The Future Value Youtube

What Mileage Does A Car S Value Depreciate Direct Car Buying

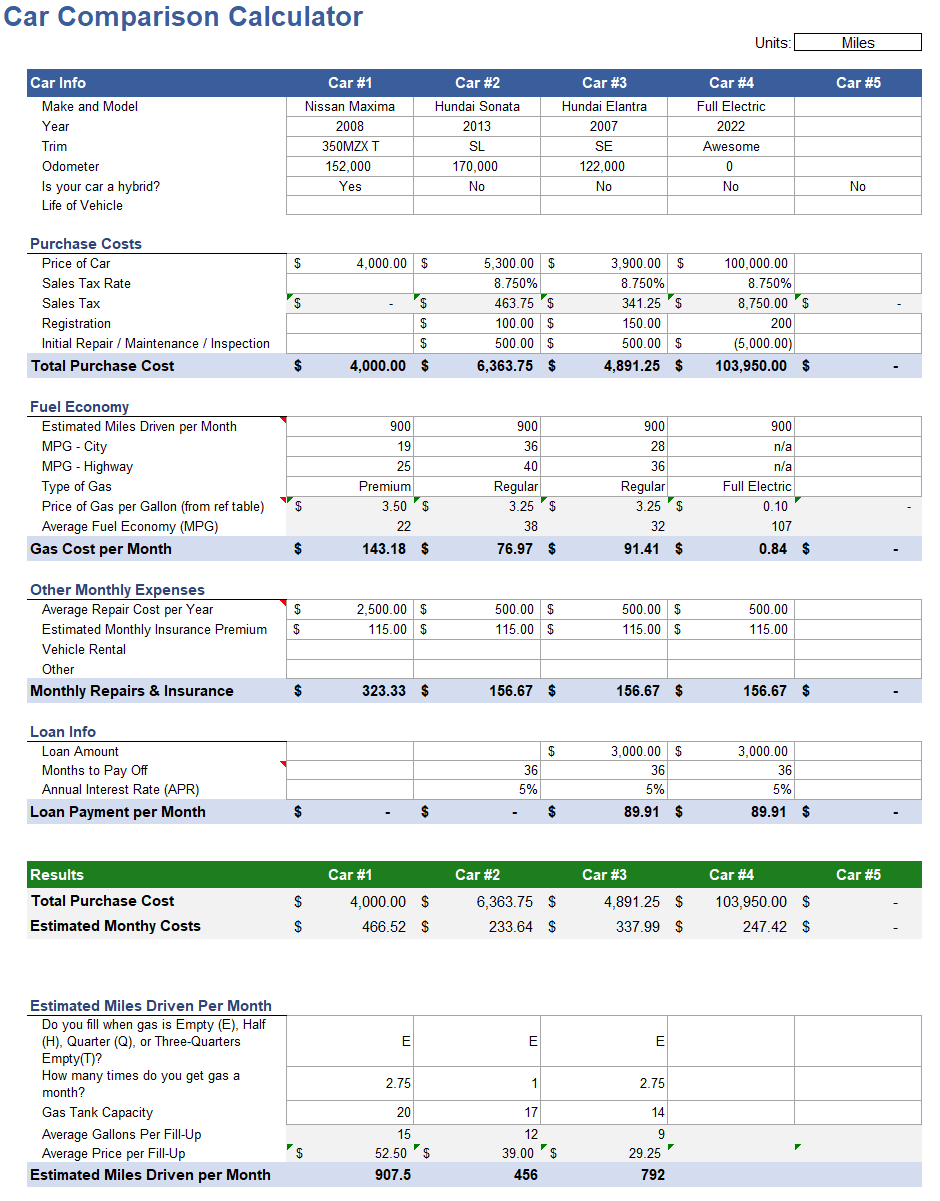

Car Comparison Calculator For Excel

Car Depreciation Explained With Charts Webuyanycar

Car Depreciation How Much Value Have You Lost Masterpole Murphy Insurance Agency Syracuse Ny Independent Auto Home Life Business Insurance Agent

Car Depreciation Expense That Is Often Overlooked Finax Eu

Car Depreciation Calculator

Car Depreciation Online Tool For Philippines Carsurvey